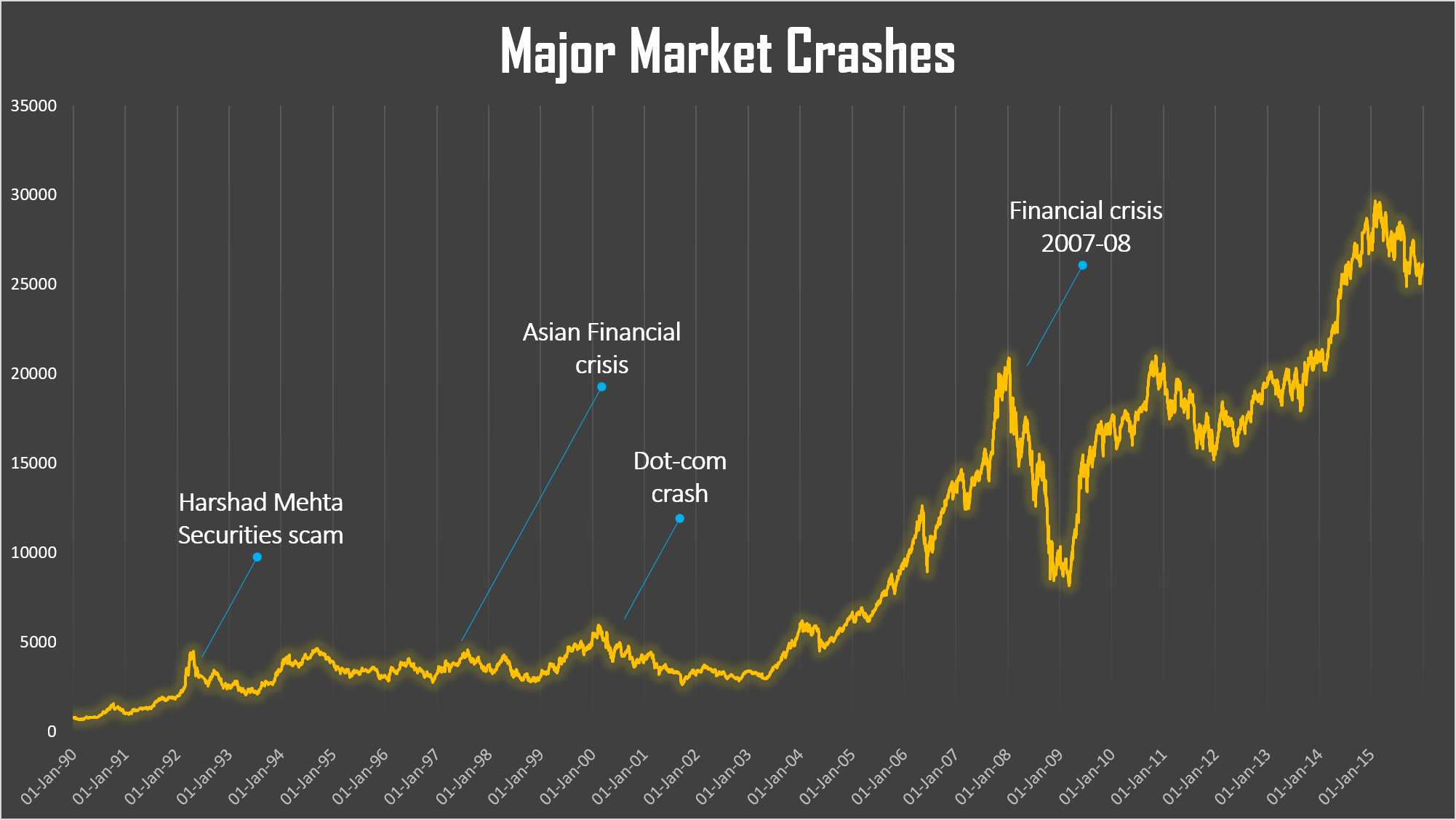

One bleak morning in April, I was skimming through the newspaper and came across an opinion piece which talked about the impact of COVID-19 on the stock market. The experts were talking about how it was the best time to buy. “Buy when there is blood on the street” was the exact quote. When the market falls by more than 20%, it is defined as a bear market. Sensex and Nifty had already lost 30% and were in deep bear territory.

The more I read about it the more did I realize that like many of my peers I had absolutely no clue. So I decided to look at this objectively, are people investing or cutting their loses? What do the numbers look like? I came across an ET wealth survey which suggested that ~20% were looking to buy, another 20% were not making any changes to their portfolios and 10% were looking to get out while the remaining 50% were planning to buy slowly as markets recede.

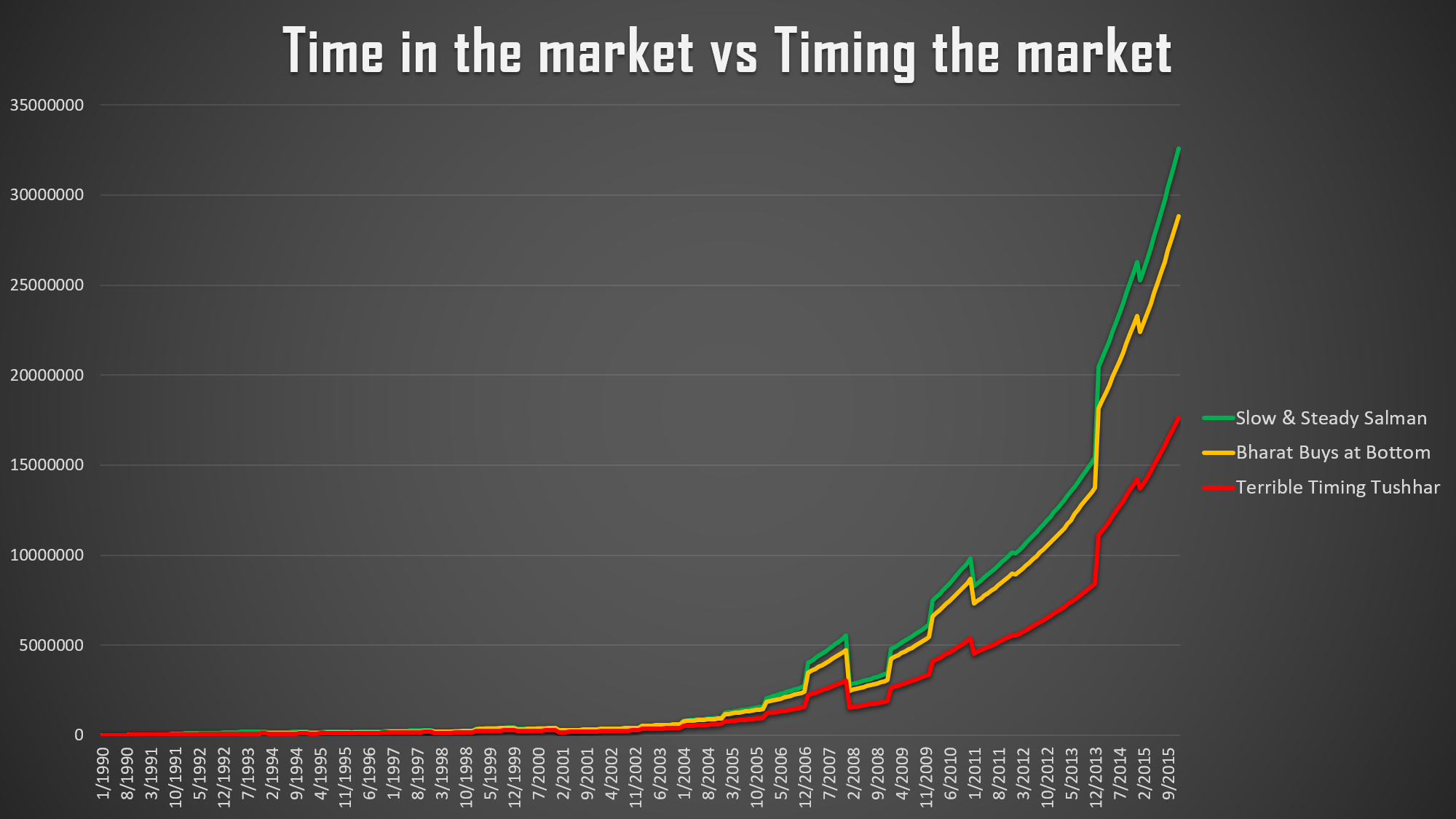

Now having established the fact that majority of investors were looking to time the market, I looked through N number of news articles, KOL blogs, analogous markets, etc. to understand the leading indicators for successfully timing the market. Finally, after a week of research I took a step back to see if timing the market was in fact the right thing. So, I downloaded the historic BSE data going back 30 years. I dumped everything in an excel and modelled three different portfolios based on three very different investment strategies. Tushhar, Bharat and Salman saved ₹2,000 per month since 1990 for a total of ₹6L. But after 25 years they all ended up with different amounts based on their investment strategy.

Terrible Tushhar!

Tushhar saved ₹2000 per month in a savings account earning 3% interest rate waiting for the perfect time to invest. But it turns out Tushhar had the world’s worst timing. He dumped all his savings into the market on the day before the 4 biggest market crashes. He started by saving for the first few years only to put his money in at the absolute market peak, right before the Harshad Mehta securities scam that resulted in a 13% crash. But Tushhar did not let the bear market frighten him and never sold, and instead started saving his cash again, only to do the same at the next three market peaks. Every time he invested the full amount of his saved cash only for the market to crash immediately after. Most recently during the 2007-08 financial crisis, he invested all his money the day before the markets stumbled by 11%. He’s been saving cash ever since waiting for the next market peak.

Even with his terrible timing, thanks to his buy-and-hold strategy Tushhar’s ₹6L turned into ₹1.76 Cr. Despite investing only at each market peak, his big nest egg is thanks to the power of buying and holding. Since he never sold, his investment always managed to recover and flourish over time.

“Buys-at-Bottom” Bharat

Bharat, in stark contrast to Tushhar, was omniscient. Similar to Tushhar, he also saved his money in a savings account earning 3% interest, but he correctly predicted the exact bottom of each of the four crashes and invested all of his saved cash on those days. After investing, he started saving up for the next market crash. It is something of a rare feat to successfully predict the bottom of a market not once but four times. 1997 was a year of financial crisis that gripped much of Southeast Asia raising fears of a worldwide economic meltdown due to financial contagion. The market dropped 6% and Bharat didn’t jump in until it fell all the way down by 12%, perfectly predicting the exact moment it had no further to fall and dumped in all of his cash just in time for the recovery.

For this rare feat, Bharat was rewarded. His ₹6L of savings has grown to ₹2.8 Cr today. It’s definitely a significant improvement compared to Tushhar; the absolute best trumps the absolute worst market timing by close to 60%. Both Bharat and Tushhar can thank “the buying and holding a low cost index fund” strategy for a vast majority of their wealth.

Slow n Steady Salman

Salman was more unsophisticated and didn’t try to time the market peaks or valleys. He never had the habit of watching stock prices or listening to expert opinions. The only thing he did was to set up a ₹2,000 per month auto investment in an index fund when he opened his account in 1990. Then he never looked at his account again. Every month his account would automatically invest ₹2,000 more in his index fund at the current price. He invested at every market peak, every market bottom and every month in between. But his money never sat idle in a savings account earning 3% interest.

After 25 years, Salman signed up for online access to his account (since the internet had been invented since he last looked at it). He was pleasantly surprised with what he found. His slow and steady approach had grown his nest egg to ₹3.3 Cr. Although he never had Bharat’s impossibly perfect ability to recognize the bottom of the market, Salman’s investment crushed Bharat’s by more than ₹37L or 13%.

So moral of the story is that time in the market beats timing the market. Invest early and often!